Towards a Seamless Payment System: Paving the Way for East African Integration

Cross-Border Mobile Money Transactions

For the period of January to August 2023, Tanzania received a total of 1,131,286 international visitors. The largest portion of visitors is from Kenya, which has 11% of the total international visitors. Tanzania is among the top ten countries that visit Kenya as tourists. This shows that countries in East Africa interact more compared to others. While these interactions have economic impacts, there is a need to create an efficient payment method for foreigners as visitors need to transact.

In the international setting, VISA, Mastercard, and the like have solved the problem. While these international payments are available in East Africa, there is a problem with their usage. In East Africa, mobile money is more used than other means of payment. Considering that mobile money is preferred as a means of payment in East Africa compared to VISA and MasterCard, it calls for East Africa to think of an innovative way to make sure that the payments become convenient to drive cross-border trade, people, and capital movement.

The Existing Problem

For various reasons, some African Countries are more cashless than others as is in the case of East Africa where Kenya is more cashless than Tanzania. The challenge comes when a visitor is required to change money to transact as they may not have the payment means that is used in a specific country. For example, while one may change Tanzanian Shillings to Kenyan shillings considering that Kenya is more cashless changing the money does no good when purchasing from retailers. The retailers are using Mpesa, and while it is easy for one to get a sim card that operates in Kenya, the option is untenable for short-term visiting individuals.

A step to the single currency in East Africa

The East African Community (EAC) is a regional organization with 7 Partner States, headquartered in Arusha, Tanzania. It has 283.7 million citizens and has a combined GDP of $305.3 billion. The EAC promotes cooperation in political, economic, and social spheres. It was established by a treaty signed in 1999 and has seen several countries join, with the most recent being the Democratic Republic of the Congo in 2022. The EAC is actively pursuing regional integration, including the development of the East African Customs Union, Common Market, and the East African Monetary Union Protocol.

EAC Partner States aimed to achieve a single currency for the region by 2024. As we are in last quarter of 2023, it is clear that the single currency is far from reality. But we can work to establish a means for payments that will work for all East African people who are used to Mobile money than other means of payments.

Before getting into a single currency EAC has to establish a single system of payment that will work from the small payments to retailers. Some telecommunication companies are working across the country. They are in a position to make this possible. This is different from being able to send money from one country to another but focuses on making it possible for a foreigner to make payments without the need to exchange the currency. This should be similar to what VISA and Mastercard are doing although it has to be customized to work on mobile money which is mostly used in East Africa.

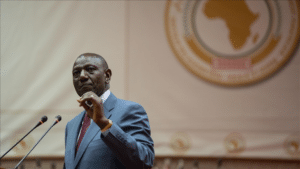

“Ruto emphasized that regional integration should eliminate concerns about currency choice for trade, addressing non-tariff barriers to promote trade, and integration.”

Slowly but sure

Kenya’s President William Ruto proposed the creation of a single African currency to ease trade across the continent at the COMESA summit in Zambia. Ruto emphasized that regional integration should eliminate concerns about currency choice for trade, addressing non-tariff barriers to promote trade and integration.

Ruto’s proposal is similar to the EAC goal of the single currency. From him, we see a political willingness to reach the EAC goals. However, for the start, before the single currency, we should have a single payment system that will work for all East African countries. The payment system should be in a way that is convenient and inclusive. The successful payment system should be viable for people who are limited in accessing international payment systems like MasterCard. Recently, mobile payment has been a convenient and inclusive way that we may start before establishing the bill of the single currency that EAC is aiming at.

Getting there

A single payment system can be achieved by having a synchronized system among the telecom companies that provide mobile money services. The commercial banks that have the sim banking services. The EAC can establish an USSD code that will be used region-wise whenever a person wants to make a payment in a foreign country. The menu would give the exchange rates and show a person how much to pays in terms of their currency and then pay for the service on has been given. This is a bit similar to how MasterCard and VISA work, the difference being, that it is a customized version of VISA and MasterCard to accommodate the people of East Africa who are used to mobile money. The single currency can easily be achieved by firstly establishing a single payment system which is cashless.

A region-wise integrated USSD should be able to accessed even if someone is offline. This is from the fact that some people may not enable the roaming services when visiting other countries. While the path towards a single currency may be slow, focusing on a single payment system that accommodates mobile money can serve as a stepping stone towards achieving the EAC’s long-term goals.