To What Extend is the Chinese Belt and Road Initiative A Win for Intra-African Trade Aspirations

By Ezra Nnko

China-Africa Trade

The Belt and Road Initiative (BRI), is China’s proposal to build a Silk Road Economic Belt and 21st century Maritime Silk Road in cooperation with related countries to improve connectivity and cooperation on a transcontinental scale. It has been described as one of the most ambitious foreign policy initiatives of the Chinese government and aims to strengthen Beijing’s economic leadership through international trade and infrastructure programs with countries in Asia, Oceania, Europe, and Africa.

The BRI comprises the land-based Silk Road Economic Belt, which links China with Europe through Central and Western Asia, and the sea-based 21st century Maritime Silk Road, which connects China with Southeast Asian countries, Africa, and Europe. Forty-nine (49) African countries together with the African Union (AU) have joined the BRI by signing an MoU with China. While the MoUs are not legally binding, they formalize Chinese investment in the country, with due acknowledgment from the local government.

The BRI and AfCFTA in Africa

China has been Africa’s largest trade partner for 14 consecutive years. The trade between China and Africa in 2023 grew a modest of 1.5 percent from 2022 to US$ 282.1 billion. As Chinese exports to Africa reached US$173 billion; an increase of 7.5 percent over 2022, the imports from Africa dropped by 6.7 percent to US$ 109 billion. The main products China exports to Africa are machinery and electronics, textile and apparel, hi-tech products, and finished goods, while imports from Africa are crude oil, iron ore, cotton, diamond, and other natural resources and primary goods. South Africa is China’s largest trading partner among all other African economies as it accounts for 19.9 percent of total trade within the continent followed by Nigeria and Angola.

AfCFTA is viewed as an economic proposal to boost the African economy through the liberalization of its economy. The agreement does not necessarily “enforce” the member states towards its implementation. This allows member states to seek extra trade partners; a chance for China to grab it through bilateral agreements.

“While most of the projects that China is pursuing in Africa, under the BRI do help create infrastructure, industry, and connectivity across the continent, they are immensely beneficial for Chinese companies in utilizing its overcapacity and bringing labor and materials to Africa.”

The relations between China and Africa date back to the de-colonization struggle and in the post-independence era. This relationship has been used more and more with China moving closer to Africa. Their relationship has been regarded as mutual by both parties. Today, China’s political leadership views economic relations with the continent as a means to achieve the country’s development goals. Within a few decades, China has emerged as Africa’s biggest bilateral trading partner, Africa’s biggest bilateral lender, as well as one of the biggest foreign investors in the continent. The trade relationship between China and Africa has gradually become stronger while intra-trade between African States has been in a weak state. Chinese companies have entered almost every African market. Today there are more than 10,000 of such entities operating in Africa where some one million people of Chinese descent reside in Africa.

China has created its “own” trade cycle in Africa. This is based on the concept of connectivity which lies in how China uses its influence in Africa through Investment and Trade, as it creates a necessity for the African governments to invest in infrastructure to create suitable space for trade and FDIs.

China provides loans to African governments to build “Mega Infrastructure Investment” while the majority of this infrastructure connects China’s strategic resource areas in Africa. 20 percent of all its rail and road line projects in Africa have been linked to its Industrial zones.

For instance, an oil refinery in the North of Sudan is located close to a railway line connecting Port Sudan and Dakar Port in Senegal. An industrial park in Ethiopia is located near the Addis Ababa-Adama Highway, which connects with the Addis-Djibouti railway line connected to the Djibouti port. China’s government loaned 70 percent of the 756km railway worth $4 billion to Ethiopia and the railway was constructed by China’s State-owned Companies.

Of the 49 countries that signed the BRI MoU, 34 (nearly 70%) are located along the coast of Africa. This enables China to use maritime routes to transport raw materials such as Phosphate, copper, cobalt, gold, iron ore, cocoa, bauxite, coal, lithium, steel, granite, and marble back to the mainland, and transfer ready-made cheap products to Africa.

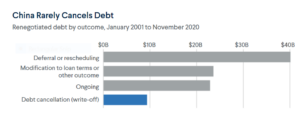

Despite China’s claim of altruistic intent, many of the projects are controversial. Especially with the debt sustainability issues, Chinese loans used for infrastructure development have put several governments in a difficult spot especially after their debt renegotiation, extending far into the future.

What AfCFTA and Africa should do?

For a long time, China has been deciding what it should do in Africa. It is time for Africa to influence Chinese investments in Africa, through the AfCFTA, by recommending important areas that China might invest in to boost economies and the implementation of the AfCFTA agreement.

BRI has to be integrated into AfCFTA, although its integration has to be limited. China’s investment in Africa must focus on industrialization and technology. These investments must be focused on put Africans at the center of production. The industries should manufacture products derived from raw materials produced in the countries concerned.

While most of the projects that China is pursuing in Africa, under the BRI do help create infrastructure, industry, and connectivity across the continent, they are immensely beneficial for Chinese companies in utilizing its overcapacity and bringing labor and materials to Africa. The skilled labor in industrial projects is mostly from China, with a few African locals taking up low-end employment. Africa should begin importing industrial technology and use the infrastructure that has been built between these countries to facilitate intra-trade between the member states. To protect local products under the AfCFTA agreement, Africa should increase the tariff on Chinese imported goods.

These are the writer’s own opinions and do not necessarily reflect the viewpoints of Liberty Sparks. Do you want to publish in this space? Contact our editors at [email protected] for further clarification.